IFRS 10 Consolidated Financial Statements

Tax Guide: IFRS 10 Consolidated Financial Statements

SCOPE

Parent entities shall present consolidated financial statements unless:

- It is wholly owned, or partially-owned subsidiary of another entity and all of the owners do not object to the parent preparing consolidated accounts

- Its debt or equity instruments are not traded in a public market

- It has not filed, or is in the process of filing its financial statements with a regulator for the purpose of issuing instruments in a public market

- Its ultimate or an intermediate parent produces consolidated financial statements in accordance with IFRS Accounting Standards, and they are available for public use

- It is an investment entity (See discussion below)

IFRS 10 does not apply to interest in post-employment or other long-term employee benefit plans to with IAS 19 Employee benefits applies.

DETERMINING CONTROL

An investor shall assess its involvement with an entity (the investee) to determine whether it has control over the investee.

Investors should consider all facts and circumstances when assessing control and reassess if there is a change in circumstances.

Control can also exist over a portion of an investee and it can be treated as a separate entity where specified assets are the only sources of payments for specified liabilities or other interests in the investee. In such instances the investor shall assess that portion (or silo) of the investee separately for control.

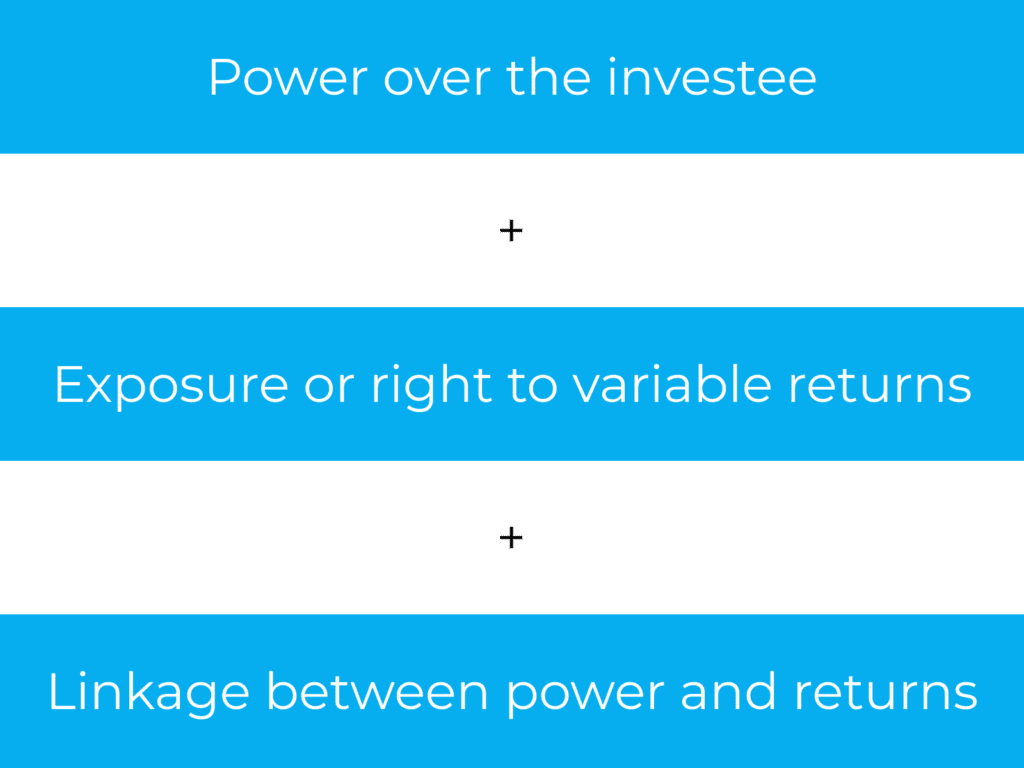

Investor controls an investee if all the following exist:

PURPOSE AND DESIGN

In assessing whether control exists and applying these criteria. The Investor must consider the purpose and design of the investee in order to identify

- The relevant activities

- How decisions about relevant activities are made

- Who has the ability to direct those activities

- Who receives returns from those activities

In certain cases, voting rights (i.e. if unrelated to relevant activities) may not be the dominant factor of control of the investee.

Relevant activities

Relevant activities may include a variety of operating and financing activities, including potentially:

- Selling or purchasing goods or services

- Managing financial assets

- Selecting, buying and selling assets

- Research and development

- Determining funding structures and obtaining financing

Relevant decisions may include either:

- Making the operating and capital decisions and budgets

- Appointing, remunerating and terminating the employment of the key management personnel or other relevant service providers

POWER

Power comes from rights. Investors must have rights that give it the current ability to direct the relevant activities of the investee.

Power is the right to direct the relevant activities, even if that right is not exercised. Rights can arise from:

- Voting rights, or potential voting rights (typically from equity interests)

- Rights to appoint or remove key management personnel who direct the relevant activities

- Rights to appoint or remove an entity that directs the relevant activities

- Rights to direct the investee or veto transactions of the investee

- Other rights including rights that arise via contract, that gives the investor power to direct the relevant activities

Substantive rights

Investors shall only assess substantive rights in assessing whether they have power. Rights are substantive when the investor has the practical ability to exercise those rights. Factors that may stop rights from being substantive include:

- Economic or other barriers to exercising the investors rights

- Exercise of rights requires the agreement between multiple parties and not mechanism is in place to practically allow them to exercise those rights collectively

- The holder of rights, particularly potential rights, would not benefit from the exercise of those rights

Usually, to be substantive rights need to be currently exercisable, or at least exercisable when decisions about relevant activities are made.

Protective rights

Protective rights are rights that relate to the fundamental decisions of the investee such as changes to its underlying activities and often only apply in exceptional circumstances and protect the investors interest. Protective rights do not give the investor rights to control the relevant activities. Franchise arrangements are generally considered protective rights.

Voting rights

Where relevant activities are directed by vote, or a majority of the governing board is appointed by a vote, Generally an investor that has more than half the voting rights of an investee has the power. However, an investor without the majority of voting power may have power if any of the following apply (‘De-facto control’):

- A contractual agreement between the investor and other vote holders, sufficient to give the investor power

- Contractual arrangements over decision making rights, along with voting rights can give the investor power

- Other vote holdings are small and widely dispersed, such that the investor is likely to always be able to achieve their desired outcomes

- Potential voting rights that are currently exercisable when combined with existing voting rights can give the investor power. Potential voting rights are only considered if substantive

EXPOSURE TO VARIABLE RETURNS

The investor should be exposed to variable returns from the investee. Returns can be only positive, only negative or both positive and negative returns.

Returns can include:

- Dividends, interest and other distributions of economic benefit, as well as change in the value of the investment

- Remuneration for servicing an investees assets or liability, inkling fees, tax benefits, residual interest in the investees assets and liabilities on liquidation, exposure to loss from providing credit or liquidity support

- Returns not available to other interest holders, such as being able to achieve economies of scale, access to proprietary knowledge or limiting the operation of the investees assets to enhance other assets of the investor

LINKAGE BETWEEN POWER AND RETURNS

An investor only controls an investee if it as the ability to affects is return by using its power. This also includes considering whether the investor is principal or agent in exercising its decision making powers. This should include considering

- The scope of the decision making authority

what decision are they permitted to make and what level of discretion they have when making those decisions - The rights held by other parties

Substantive rights of other parties may restrict the decision making ability of the investee - The remuneration to which it is entitled to

the greater the size and variability of the decision makers remuneration relative to the returns expected from the activities of the investee, the more likely that the decision maker is a principal - The decision makers exposure to variable returns from other interests in the investee

the investor should consider if the returns from all of its interests in the investee. In addition if the decision makers exposure to variable returns different to that of other investors and will this influence its actions, this may indicate it is a principal.

CONSOLIDATION APPROACH

Consolidated financial statements should be prepared from the date the investor obtains control over an investee and cease on the date that the investor loses control.

Consolidated financial statement should be prepared using uniform accounting policies.

The process of preparing consolidated financial statements:

- Combines like items of assets, liabilities, income, expense and cash flows of the parent and subsidiary

- Eliminates the parents investment in each subsidiary and the parent’s portion of the equity of that subsidiary

- Eliminates in full any intragroup assets, liabilities, income and expenses and cash flows relating to transaction between group entities

Non-controlling interests

Non-controlling interests (NCI) shall be presented separately in the statement of financial position as a separate component of equity.

Changes in ownership interest that does not result in the parent losing control, are accounted for as equity transactions.

Loss of control

When a parent loses control of a subsidiary, the parent must:

- Derecognise all assets and liabilities of the former subsidiary

- Recognise any investment retained initially at fair value

- Recognise a gain or loss associated with the loss of control.

INVESTMENT ENTITY EXEMPTION

An investment entity is an entity that:

- Obtains funds from investors with the purpose of providing investment management services

- Commits to investors that the purpose is to invest funds for capital appreciation, investment income or both

- Measures and evaluates performance of substantially all investments on a fair value basis

Entities that are considered to be investment entities do not consolidate its subsidiaries, or apply IFRS 3 Business Combinations when it obtains control.

Investment entities measure their investments in subsidiaries at fair value through profit or loss in accordance with IFRS 9 Financial Instruments.

DISCLOSURE

Refer to IFRS 12.

CONTACTS

| BOAZ DAHARI Moore Israel [email protected] | KRISTEN HAINES Moore Australia [email protected] | TAN KEI HUI Moore Malaysia [email protected] |

| CHRISOF STEUBE Moore Singapore [email protected] | NEES DE VOS Moore DRV [email protected] | TESSA PARK Moore Kingston Smith [email protected] |

| EMILY KY CHAN Moore CPA Limited [email protected] | PAUL CALLAGHAN Moore Oman [email protected] | THEODOSIOS DELYANNIS Moore Greece [email protected] |

| IRINA HUGHES Johnston Carmichael [email protected] | SAHEEL ABDULHAMID Moore JVB LLP [email protected] |

MOORE IFRS in Brief is prepared by Moore Global Network Limited (“Moore Global”) and is intended for general guidance only. The use of this document is no substitute for reading the requirements in the IFRS® Accounting Standards issued by the International Accounting Standards Board (IASB). This document reflects requirements applicable as at the date of publication, any amendments applicable after the date of issuance, to the IFRS® Accounting Standards have not been reflected. Professional advice should be taken before applying the content of this publication to your particular circumstances. While Moore Global endeavors to ensure that the information in this publication is correct, no responsibility for loss to any person acting or refraining from action as a result of using any such information can be accepted Moore Global.