The market value of leading listed companies in the world’s most important sectors has increased by 15% in the past two years, according to the new Moore GCF Market Valuation Index.

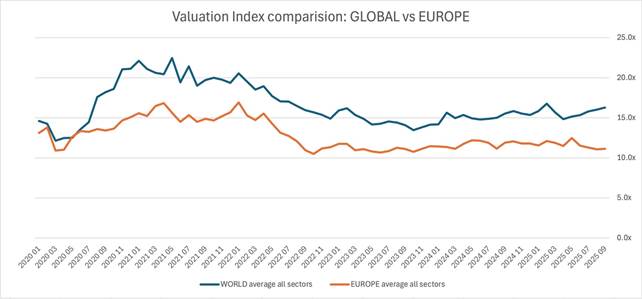

Our data shows the global earnings multiple across key sectors of the world economy rose steadily over the summer to reach 16.3x EBITDA by September 30. In contrast, the average multiple for companies in Europe was just over 11x.

There was a significant drop in the Index in April at the height of uncertainty about the impact of new US tariffs on supply chains and global trading patterns.

With companies and economies adjusting to the new higher-tariff reality, there has been a steady increase in earnings multiples since the start of the summer. However, the Index is well below the levels seen between the autumn of 2021 and the spring of 2022, when multiples were around 20x EBITDA.

A Solid Foundation for M&A

The Market Valuation Index was created for Moore Global Corporate Finance (GCF) by member firm Moore ASZ-Attolini Spaggiari Zuliani & Associatiin Italy using a combination of artificial intelligence and industry databases.

“This new index is amazingly effective in showing trends across different industrial sectors and different regions of the world,” says Giancarlo Attolini, founder and partner in Moore ASZ. “Using this data, GCF teams can assist owners understand the true value of their businesses in relation to market trends.”

The GCF Index analyses the earnings multiples of listed companies across 13 sectors that generate around half of global GDP – creating results for the world as a whole and Europe on its own.

It will be updated regularly to give company owners and their professional advisers a solid foundation when considering their investment or M&A strategies.

Multiples of EBITDA (earnings before interest, taxes, depreciation and amortisation) is used as the metric for calculating valuations as they are widely used by Moore GCF and other corporate finance professionals as a starting point in assessing the enterprise value of a business.

Earnings multiples give a clear picture of the core profitability of a business as they ignore different tax rates, capital structures and accounting methods which may cloud the picture.

Index data is based on stock market prices and public filings by listed companies but there is a widely accepted mechanism by which listed company earnings multiples can be discounted for privately held companies.

4 Most Valuable Sectors

Software solutions businesses show the highest earnings multiples in the first GCF Market Valuation Index – almost 40x – that is double the global average. It is almost 50% higher than the three closest industries.

However, this represents a significant fall from the highs seen in the spring of 2021 when multiples topped 60x. Those peaks can be attributed to Covid and its aftermath, with a mini boom in stock prices and M&A activity following the pandemic.

The dip at the start of 2025 is linked to uncertainty about the US government’s decision to hike tariffs on imported goods and its impact on relations between the US and China – the two biggest markets for technology.

The three sectors immediately below software in the rankings are: media and entertainment; consumer products manufacturing and renewable energy.

Media and entertainment multiples were comfortably above 30x at the height of Covid when streaming giants like Netflix and Disney were signing up subscribers confined to home by lockdowns. They have receded to just below 25x.

The same levels are recorded by consumer products manufacturing – which had been stuck around 15x until the end of 2024 – and renewable energy.

The renewables multiple has been much higher – well above 35x at the start of 2021 – but the race to net zero has become less intense as governments weigh up the high cost of alternative energy sources and faltering consumer demand.

Europe Lags World Index

Another striking point that emerges from the Index data is the contrast between the overall world index across the 13 sectors and European companies on their own in the same industries.

In short, Europe is lagging the global average by almost 50%.

Much of the gap can be attributed to the disparity in the four most valuable sectors, outlined above, as the other industries in the rankings are fairly evenly matched.

Other causes may be that the European market is more fragmented than the US, as well as the lack of a unified capital market for the Eurozone.

About Moore Global Corporate Finance (GCF)

The Market Valuation Index was created by Moore Global Corporate Finance (GCF) a network of firms that has built particular expertise in the cross-border mid-market deals. This segment outperformed the total M&A market last year in terms of volume and growth in the average value of deals, according to GCF’s Compass report. The total value of global cross-border mergers and acquisitions involving mid-sized companies rose to €180 billion last year. The average deal value in the sector was €50.6 million in 2024, which is higher than each of the past six years except 2021 when there was a short bounce after the pandemic. For more information visit: www.moorecf.com