Industry 4.0, Brexit, trade tariffs and rising tensions in the Middle East. A smorgasbord of business risk, each creating uncertainty. Sensible businesses will seek to mitigate risk, with the activities required consuming enormous amounts of resources, in the form of currency, time and human capital. Manufacturing & Distribution companies in the middle-market have a finite amount of these resources, so making the right decisions the first time is critical. Like most complex business issues, the best chance of success is to adopt a strategy with your leadership team and align all goals and tactics with that strategy. Communication is critical throughout the process, and mid-process adjustments will be necessary, so timely monitoring of progress is required. The head in the sand approach seldom works: just ask the owners of Blockbuster.

Here’s how the Moore Manufacturing & Distribution group is thinking about 2020’s key sector risks:

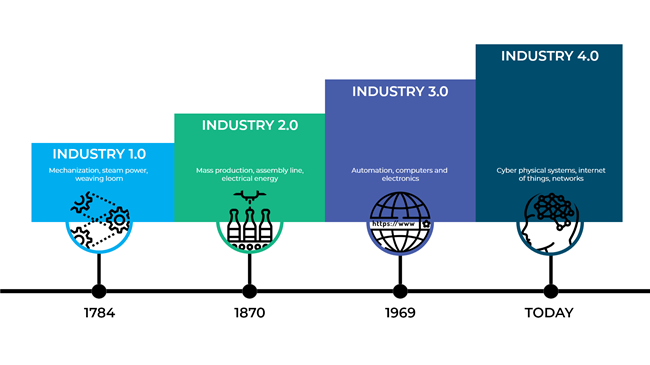

Industry 4.0

The digital transformation taking place is less about products, materials and equipment and more about the integration of human needs and capabilities (including vendors and customers), with machine learning and data. With concepts such as augmented reality and the Internet of Things, the language, let alone the reality of Industry 4.0 can be daunting. Perhaps this is why, to date, few middle market companies have implemented comprehensive Industry 4.0 strategies.

Alternatively, adopting a strategy which is focused on multiple, sequential, incremental improvements can have a significant effect on an organisation. For example, before trying to create a digital thread between your suppliers and customers, fix the problems with your own systems. Most middle market companies lack integrated internal systems for efficient sharing and utilisation of data. If your front-office systems (for sales, marketing and other customer-facing functions) and your back-office systems (for accounting, tracking, fulfillment and operations) can’t communicate, you end up with information silos. As a result, your daily business processes can’t run seamlessly. Executing an order-to-cash process, for example, may involve much paper and manual transfers of information as the order makes its way from department to department. Systems integration removes these silos, so you can streamline your processes and enable your employees to do their jobs more efficiently, using whatever interface they need. It also gives you clear visibility into your business, from the moment a quote is approved until you collect payment.

Source: Accountancy Resource Group

Brexit

The UK general election result, with a sizeable Conservative party majority, effectively removed any remaining doubts that the UK may not exit the European Union. What happens from here?On January 30 the UK will leave the EU and enter into the “Transition Period”, or “Implementation Period”. The Transition Period is a period agreed in the UK-EU withdrawal agreement in which the UK will no longer be a member of the EU but will continue to be subject to EU rules and remain a member of the single market and customs union. This will allow the UK to continue its current relationship with the EU while the future trading relationship and security cooperation is negotiated.

The Transition Period is currently scheduled to expire on December 31st 2020, but the terms of the withdrawal agreement allow the UK-EU Joint Committee to extend the Transition Period by up to two years, but it must sign off on the length of any extension before the 1st July 2020. There is widespread scepticism that the future trading relationship will be settled within 12 months, but this is the intent of the UK and EU.

The impact of Brexit is yet to be fully understood, but the reintroduction of tariffs for UK/EU trade would be likely to hurt exporters, with an as yet unquantified impact on jobs and standards of living.

So how can your business prepare?

Although it’s currently impossible to predict the effect of Brexit on your business, leadership should be determining which parts of your operations will be subjectto the outcomes of Brexit.

Questions to ask, topics to investigate and monitor include:

- How will your workforce be affected? The movement of EU and UK citizens back and forth is one of the most significant Brexit issues and will cause significant disruption, including access to talent.

- Does your business include standards which govern the work you perform, including European EN standards? Does your business own any patents, trademarks or registered copyrights? Does your company manufacture products that must certify to EU safety, security or ecological standards?

- You will need to understand the amount and types of product your company imports/exports, use of agents, licenses, fulfilment agencies, contract manufacturers and warehouses. Develop an impact strategy which could consider alternative sourcing for each operational component.

- Do your operations include treasury and tax transactions between the UK and EU? If so, you need to understand the implications of Brexit on VAT registrations, funds transfers, new regulatory requirements which will be negotiated and how access to capital will be affected (including EU grants).

- Regarding information technology, do you have locations in the UK, and data hosted in an EU country (including cloud storage)? Do any employees traveling within the EU have mobile phone coverage for both data and calls? Do you hold personal data about people based in the EU on UK servers?

All of these situations and more will be most likely be affected by Brexit. Your Company will need a pro-active strategy to identify affected areas, assess impact, determine best alternatives and implement action when appropriate.

China/US Trade Tariffs

Since the second quarter of 2018, the USthrough multiple trancheshas implemented tariffs on $550 billion worth of products imported from China. China, in retaliation, has done the same for $185 billion worth of products imported into China from the US.

On December 13th, 2019 China and the US announced they had reached a phase one trade deal, just prior to new tariffs coming into effect which would have affected electronics like smartphones and laptops, and agreed to reduce the September 1, 2019 tariffs on $120 billion of Chinese goods from 15% to 7.5%. China, for its part, has agreed to increase its purchase of US goods and services by at least $200 billion over the next two years, suspend retaliatory tariffs which were scheduled, and implement intellectual property safeguards.

The current news sounds promising, but who knows what will happen during the rest of 2020?

Some dos and don’ts that should be included in your tariff strategy:

What you should do as an importer from China:

-

Determine how you are affected – Review your product HS codes (Harmonized Tariff Schedule of the United States) and determine if they are affected by Tranche 1, 2, 3, or the proposed Tranche 4. You can work with your customs broker to determine if your imports are on any of these lists. If the country of origin is China, the penalty tariffs apply. There are tales of Chinese manufacturers suggesting that trans-shipping via Vietnam or Singapore and declaring these as the COO will avoid the 401 tariffs. This is illegal under U. S. Customs Regulations (CFR 19) as the COO must be the place where the goods are manufactured or substantially transformed, not where they are trans-shipped.

-

Budget your inventory for uncertainty – Consider that these tariffs may be removed on very short notice if a trade deal is reached.

-

Move sourcing or manufacturing to another country – Some companies are considering the move of production and sourcing to other sites in Vietnam, Indonesia, Thailand, or other low-cost countries. While the 301 tariffs don’t apply to importing from these countries so far, the future application of new tariffs is uncertain. Be aware: productivity rates in these other low-cost countries have been reported to be 20-30% lower than in China. So in the final analysis, it is often better to keep production in China and pay the penalty tariffs.

-

Consider price rises, carefully – Tariffs of 10% were much easier to absorb in the supply chain than the current 25%. Manufacturing and distribution businesses are going to have to work with their vendors and customers to get through this price volatility with minimal business disruption. You could test the market by increasing the pricing for a portion of your affected products and see how the market reacts, then consider acting on a bigger scale, depending on the market reaction

What you should not do:

-

Panic –Some companies are stockpiling inventory in advance of tariffs coming into effect. The result has been shortages of all kinds of parts worldwide for companies that are not stockpiling. In addition, hoarding parts ties up working capital and may put a stranglehold on your company’s ability to operate. In industries with rapid product development such as electronics, parts also become quickly obsolete, so buying too far in advance is a losing proposition.

-

Deliberately misclassify goods to avoid duties – The U.S. government has noticed this tactic, and is cracking down more than ever. Customs authorities have developed profiling tactics that help them target shipments for detailed examination and evaluation. Customs processing delays, as well as major fines and penalties, can be expected if your company routinely engages in these practices. In addition, many people do not realize that your shipments are not fully ‘liquidated’ until 12 months after clearance into the U.S. This means that your shipments can be reviewed for up to 12 months after clearance to assess whether they have had the correct HS Code applied. (You know that bond you pay for when importing goods into the United States? This is to pay for your duties in the event you are re-assessed and can’t afford to pay up). You can be sure post-clearance audits of shipments will increase significantly in the future.

-

Ship goods through an intermediary country – Duties are based on the ORIGIN country, not the last transit point.

Turmoil in the Middle East

Politics aside, expect the assassination of General Qassem Soleimani to destabilise the Middle East for some time. The US announced it was deploying nearly 3,000 extra troops to the Middle East as Iran vowed revenge on those responsible for Soleimani’s killing.

While defense related industries can flourish as instability reigns, this type of disruption causes increased transportation costs to most in the industry, as well as resistance from companies to invest in areas of destabilisation. The effects of this event will play-out in the months ahead, as middle market business leaders develop strategies to deal with increased transportation costs and other consequences this event will cause.

For advice on these emerging trends in M&D, please contact Mark Fagan, Global M&D Leader for Moore at [email protected]