IFRS 9 Financial Instruments

Tax Guide: IFRS 9 Financial Instruments

SCOPE

IFRS 9 Financial Instruments provides the accounting requirements for financial instruments, it does not contain disclosure requirements which are in IFRS 7 Financial Instruments: Disclosures. Excluded from the scope of IFRS 9 are:

- Interests in subsidiaries, joint ventures and associates accounted for under IFRS 10 and IAS 28

- Leases under IFRS 16, with some exceptions

- Employers’ rights and obligation in relation to employee benefit plans in scope of IAS 19

- Equity instruments in the scope of IAS 32

- Insurance contracts in the scope of IFRS 17, although some components of such contracts may be scoped in

- Forward contracts for business combinations in scope of IFRS 3

- Share-based payments in scope of IFRS 2

- Provisions in scope of IAS 37

- Rights and obligation in IFRS 15

INITIAL RECOGNITION

All financial assets (and liabilities) are:

- Initially recognised when the entity becomes party to the contract

- Recognised at fair value, plus (or minus), for those instruments not measured at fair value through profit or loss (FVTPL), transaction costs

CLASSIFICATION AND MEASUREMENT OF FINANCIAL ASSETS

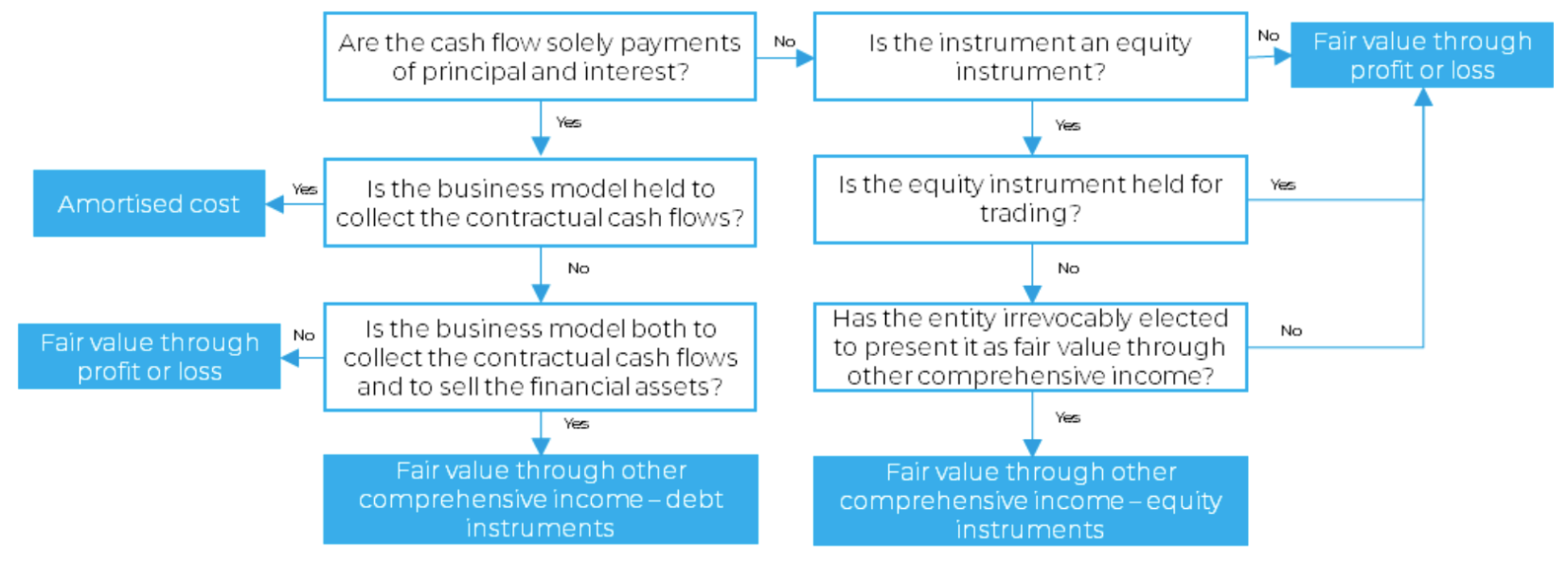

Financial assets are classified as follows:

Key considerations in the classification analysis include:

- Solely payments of principal and interest (SPPI)

The contractual cash flows should be consistent with a basic lending arrangement, with the interest reflecting the time value of money and credit risk and a profit margin.

Agreements may still be consistent with a basic lending arrangement when the cash flows are contingent on factors including environmental related factors, as long as the different alternate cash flows are not significantly different from contractual cash flows on an instrument that does not contain that contingent feature and would on their own be considered SPPI. - Business model

The business model is not assessed at an individual financial asset level but at a higher level of aggregation, although a business may have multiple business models. The business model is a matter of fact and not merely an assertion. It is typically observable through the activities that the entity undertakes, though judgment may be required.

- Held to collect

These instruments are managed to collect contractual cash flows over the life of the instruments, and would be classified as amortised cost. - Held to collect and sell

These are instruments where they are managed both to collect contractual cash flows over the life of the instrument and to sell assets prior to maturity to yield returns; these debt instruments would be classified as fair value through other comprehensive income (FVOCI). - Held for trading

SPPI Instruments that don’t meet the two categories above, are considered held for trading and would be classified as FVTPL.

When classifying financial assets, embedded derivatives are not separated out and the instrument must be classified in its entirety.

Financial assets are only reclassified if the objective of the entity’s business model in relation to the assets change.

The accounting treatment for each category is as follows:

- Amortised cost

The effective interest rate method (EIR) is used to discount the future cash flows to the initial carrying amount of the asset, interest income is then recognised at the EIR over the life of the instrument. These instruments are also subject to impairment (see discussion below). - Fair value through other comprehensive income – debt instruments

These instruments are measured at fair value. Interest income is recognised in profit and loss using the EIR method, along with impairment losses (See discussion below). All other movements in the fair value are recognised in other comprehensive income. - Fair value through other comprehensive income – equity instruments

This designation is irrevocable and is made on an instrument-by-instrument basis.

The equity instruments are measured at fair value. Dividend income on these instruments is recognised in profit or loss. All movements in fair value are recognised in other comprehensive income. No amounts are reclassified to profit and loss when the equity instruments are ultimately disposed of. - Fair value through profit or Loss

The instruments are measured at fair value and any income received and all movements in fair value are recognised in profit or loss.

IMPAIRMENT

The impairment requirements of IFRS 9 apply to the following instruments

- Financial assets at amortised cost

- Financial asset (debt instruments) at fair value through other comprehensive income

- Contract assets recognised under IFRS 15

- Lease receivables recognised by a lessor under IFRS 16

- Loan commitments for below market rate loans

- Financial guarantee contracts that are not in the scope of IFRS 17

Impairment losses shall be calculated based on the expected credit loss (ECL) approach, which reflects the losses that are expected to incur in the future for the financial assets.

General approach

The general approach shall be applied to all instruments noted above unless the simplified approach is permitted (see below). The General approach has a three-stage approach:

- Stage 1 – 12 month ECLs

On initial recognition and subsequently, a provision is recognised for losses that are expected to occur in the next 12 months. - Stage 2 – Lifetime ECLs

If there is a significant increase in credit risk, the provision is recognised for all losses expected to occur over the life of the instrument. Interest income (EIR) is still recognized based on the gross carrying amount.

As a practical expedient, an asset that is more than 30 days past due is assumed to have a significant increase in credit risk.

- Stage 3 –Credit impaired

If the financial asset is impaired, the actual loss incurred to date, as well as all future life time losses are recognised. Interest income (EIR) is also recognised on the net balance of the asset.

Simplified approach

- Is mandatory for trade receivables and contract assets without significant financing components

- Optional for trade receivable and contract assets with a significant financing component, and lease receivables.

In applying the simplified approach, loss allowances are recognised as life-time expected credit losses.

CLASSIFICATION AND MEASUREMENT OF FINANCIAL LIABILITIES

Financial liabilities are measured as follows:

- Amortised cost

the default category if none of the others apply. Amortised cost is calculated consistently with the requirements for financial assets at amortised cost using EIR. - Fair value through profit or loss

Financial liabilities are measured at FVTPL if they are

- Held for trading

- Derivatives

- Contingent considerations in a business combination recognised in accordance with IFRS 3

- Designated as such on initial recognition to reduce an accounting mismatch, or if part of a group of financial instruments that are managed on a fair value basis

- A hybrid contract designated as such if the contract contains a host not in the scope of IFRS 9 and embedded derivatives

If a liability is designated at FVTPL, the fair value changes attributable to credit risk are presented in OCI (no subsequent reclassification to profit or loss upon disposal), all other fair value changes are presented in profit or loss.

- Financial Guarantees and commitments to provide loans at below market interest rates

These shall be recognised at the higher of:

- Loss allowance calculated in accordance with ECL provisions (see above)

- Amount initially recognised less any revenue that has been recognised in accordance with IFRS 15

- Financial liabilities that arise when a transfer of a financial asset does not qualify for derecognition

Recognised at the amount initially received on the transfer, and subsequently, the expense in relation to the liability will be equivalent to the income recognised on the associated asset. .

Financial liabilities cannot be reclassified after initial recognition.

Embedded derivatives within financial liabilities can be separated and accounted for separately if the economic characteristics of the embedded derivative and host instrument are not closely related.

DERECOGNITION

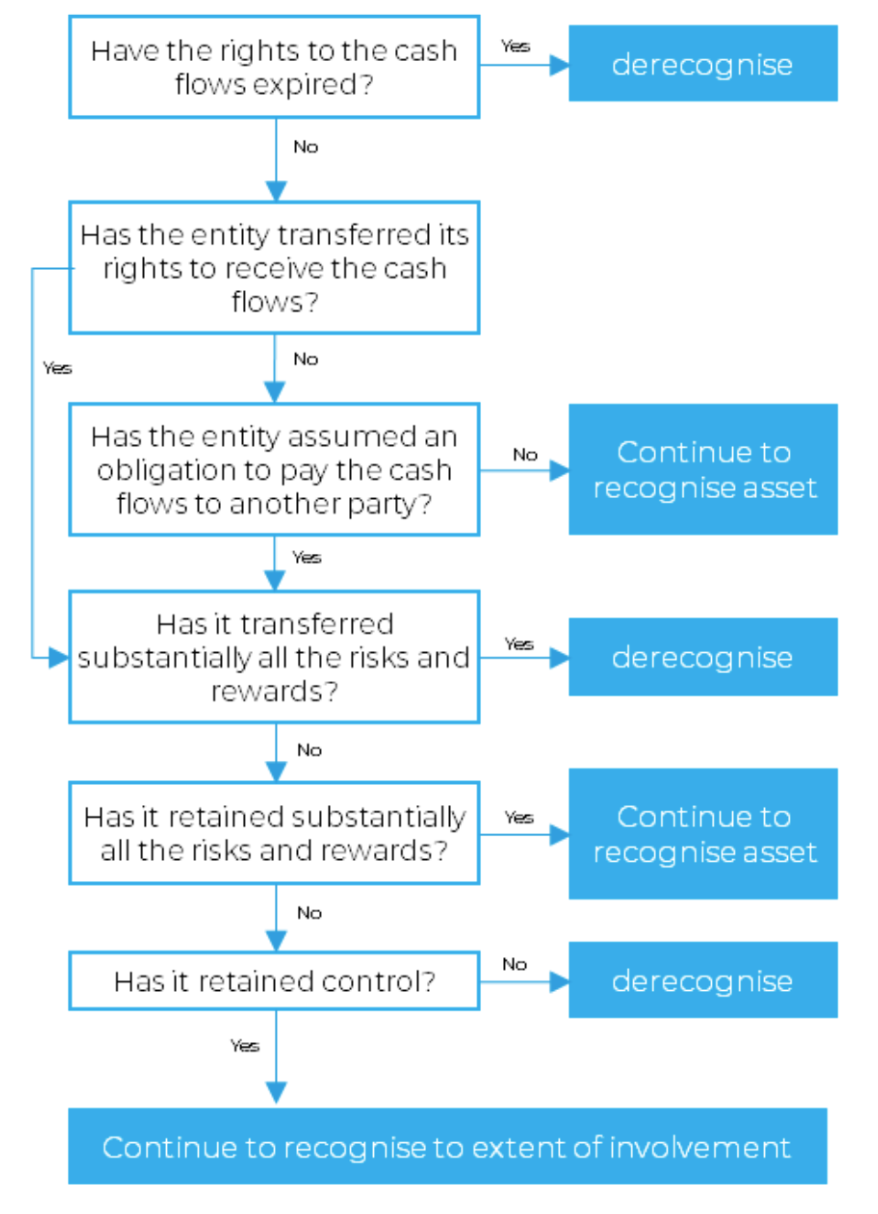

Derecognition of financial assets

In consolidated financial statements, assessment of derecognition of financial assets, should occur at a consolidated level after all intragroup transactions have been eliminated.

Entities also need to consider whether the derecognition criteria applies to parts or all of an asset.

The criteria for derecognition of a financial assets are:

Derecognition of financial liabilities

A financial liability shall only be derecognised when it is extinguished by the obligations being discharged, cancelled or expired.

When a loan instrument is changed with substantially different terms, the change in the terms shall be accounted for as an extinguishment and the recognition of a new financial liability.

HEDGING

Hedge accounting allows entities to reflect the entities’ risk management activities that use financial instruments to manage risks that could affect profit or loss (or other comprehensive income when the hedged item is an equity instrument that is fair value through OCI).

Hedges require:

- Hedging instruments

Must be a financial instrument with an external party and either

- Derivative instruments at FVTPL

- Non-derivative instruments measured at FVTPL, excluding liabilities where own credit risk is recognised in OCI

- For hedges of foreign currency risk, the foreign currency component of a non-derivative instrument not measured at FVTPL

Hedging instruments must be designated for their full duration, but can be designated for a proportion of their notional amount.

Entities may exclude from the hedging instrument designation:

- Time value of purchased options

- Forward element in forward contracts

- Hedged Items

Hedged items can be single items or a group of items and must be reliably measurable. See discussion below for permissible hedged items for the different types of hedges.

To hedge a group of items, all items must be eligible hedged items, and be managed together for risk management purposes.

- Documenting hedges

Hedges must be formally documented at the inception of the hedge, identifying the hedged item, hedging instrument and hedge relationship and how hedge effectiveness will be tested.

The hedge documentation must demonstrate how the hedge meets all of the following requirements for hedge accounting:

- Economic relationship between the hedging instrument and the hedged item

- Credit risk does not dominate the change in fair value

- The designated hedge ratio reflects the actual quantity of hedging instrument used to manage the risk in the hedged item

Types of hedges

Hedges can be designated into any of the following hedges:

- Cash flow hedges

These hedge the exposure variability of cash flows that is attributable to a particular risk associated with a recognised asset, liability, or highly probable forecast transaction that could impact profit or loss.

The effective portion of the hedge is recognised in other comprehensive income, with the ineffective portion recognised in profit or loss.

The balance of the separate component of equity (the cash flow hedge reserve – CFHR) should equal the lower of the cumulative gain or loss on the hedging instrument since inception of the hedging relationship and the fair value of the hedged item.

If the transaction results in the recognition of a non-financial asset or liability, the balance of the CFHR is reclassified to the carrying amount of that item, this reclassification does not impact other comprehensive income. Otherwise, the balance remains in the CFHR and is released to the income statement as the financial item impacts profit or loss.

- Fair value hedges

These hedge the exposure to the variability of the change in fair value of a recognised asset, liability or an unrecognised firm commitment that could impact profit or loss, or equity if the hedged item is an equity instrument at fair value through OCI.

Both the hedged item and hedging instrument are measured at fair value with the change in fair value being recognised in profit or loss, or OCI where the hedged item is an equity instrument at fair value through OCI.

- Hedges of net investments in foreign operations

A hedge of the foreign currency exposure that arises from the inclusion of the net assets of a foreign operation are included in the consolidated financial statement.

The effective portion of the hedging instrument is recognised in other comprehensive income, generally in the foreign currency translation reserve in equity.

CONTACTS

| BOAZ DAHARI Moore Israel [email protected] | KRISTEN HAINES Moore Australia [email protected] | TAN KEI HUI Moore Malaysia [email protected] |

| CHRISOF STEUBE Moore Singapore [email protected] | NEES DE VOS Moore DRV [email protected] | TESSA PARK Moore Kingston Smith [email protected] |

| EMILY KY CHAN Moore CPA Limited [email protected] | PAUL CALLAGHAN Moore Oman [email protected] | THEODOSIOS DELYANNIS Moore Greece [email protected] |

| IRINA HUGHES Johnston Carmichael [email protected] | SAHEEL ABDULHAMID Moore JVB LLP [email protected] |

MOORE IFRS in Brief is prepared by Moore Global Network Limited (“Moore Global”) and is intended for general guidance only. The use of this document is no substitute for reading the requirements in the IFRS® Accounting Standards issued by the International Accounting Standards Board (IASB). This document reflects requirements applicable as at the date of publication, any amendments applicable after the date of issuance, to the IFRS® Accounting Standards have not been reflected. Professional advice should be taken before applying the content of this publication to your particular circumstances. While Moore Global endeavors to ensure that the information in this publication is correct, no responsibility for loss to any person acting or refraining from action as a result of using any such information can be accepted Moore Global.