Moore Global has launched the Thrive Index, a unique insight into the concerns and strategic thinking of leaders of ambitious businesses across the world.

This first edition of the Thrive Index revealed that the mid-market companies which form the backbone of the global economy are generally upbeat about the future, despite confusion over tariffs and ongoing geopolitical tensions.

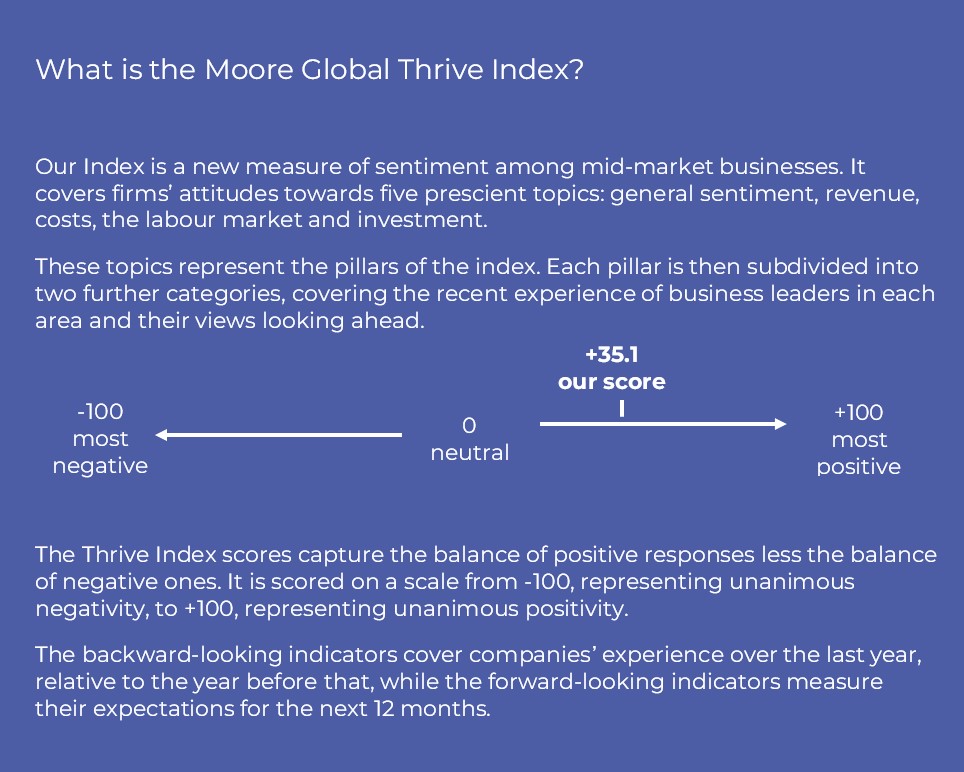

To build the Moore Global Thrive Index, we have surveyed more than 2,000 business leaders across 14 of the world’s most important economies on five key areas:

- general sentiment about the business environment

- revenue

- costs

- the labour market

- investment

These are the elements that determine success and failure in business and our first Thrive Index records the balance of positive versus negative responses to our questions.

The score for the first Thrive Index is +35.1, indicating general positivity among the leaders of mid-market businesses. Almost 75% of those surveyed improved business performance last year.

The highest score was recorded in India, at 48.7, driven by particularly strong reports of revenue, headcount and investment growth. By contrast, four of the five lowest scores were in the European Union, reflecting the slow growth outlook for the bloc.

In terms of business sectors, IT showed the highest score (44.2) while the wholesale trade was the laggard at 17.6. However, when wholesalers look ahead over the coming year their sentiment is much more positive, particularly on revenue and employment expectations.

“Our new Thrive Index is a valuable new economic indicator that measures success among the mid-market companies that drive much of global economic activity,” says Anton Colella, CEO of Moore Global.

“The findings are fascinating and illustrate the agility of ambitious mid-market business leaders. They are investing more in people and technology to gain an advantage in challenging economic conditions.”

Key findings from the research are:

- Business performance has been strong, with three out of four of companies reporting improved results over the past year. Digital transformation was the primary driver, while subdued demand remains a significant concern.

- Revenue growth has been broad-based, with two-thirds of businesses recording higher revenues. The strongest gains were reported by the most productive firms.

- On costs, 43% of firms identified labour as the main expense pressure, reflecting ongoing tightness in the employment market.

- In terms of labour force dynamics, half of businesses increased headcount over the past year. However, we also detect a significant change in attitudes to remote working with 65% of business leaders anticipating a shift back to the office.

- Investment activity is picking up as inflation moderates, with almost half of those surveyed prioritising technology and digital tools.

Below we look at each of the five pillars of our study in more detail – each of which has its own Thrive Index score looking back 12 months and looking forward to this year.

General business sentiment

Thrive Index score looking back over past 12 months +62.6

Thrive Index score looking forward to next 12 months +70.0

Businesses across sectors and geographies are positive on balance, with the tech sector most upbeat.

Three-quarters of companies in our sample saw improved business performance over the last 12 months, with all countries and sectors showing optimism for the year ahead.

The forward-looking Thrive Index score on sentiment for the coming year is almost 12% higher than that looking back – despite ongoing confusion about the full extent of US tariffs.

Among businesses recording improved performance over the past year, almost 37% ranked adoption of technology or digital transformation as the main engine of growth. A similar share – around 34% – predict tech will be the main driver going forward this year.

Meanwhile, subdued demand emerged as the main drag on performance among less optimistic respondents: 45% identified this as a major factor behind their deteriorating performance over the past year. However, only one-third expect sluggish demand to have the same impact going forward.

The effect of US trade policy shifts can be seen in the perceived impact of macroeconomic trends on businesses surveyed. Around 30% of decisionmakers blamed it on deterioration last year but almost 40% expect it to be the main impediment in the coming 12 months.

Revenue

Thrive Index score looking back over past 12 months +54.0

Thrive Index score looking forward to next 12 months +64.3

Two-thirds of the mid-market companies in our survey reported improvements in revenue in the past 12 months and there was strong expectation of further advances over the coming year.

Indian firms were the most optimistic. Some 80% recorded stronger revenue growth over the last year, while 90% expect income to increase over the next 12 months.

What becomes clear digging into the data is that the most productive firms – those with the highest level of output per head – were the strongest performers in terms of revenue growth.

Business Costs

Thrive Index score looking back over past 12 months -42.3

Thrive Index score looking forward to next 12 months -57.3

This is the one pillar of the Thrive Index which is negative, both looking back and projecting forward.

More businesses reported rising than falling costs over the last year. The same was true when considering expected changes over the coming year.

UK companies, which are expected to experience the worst inflation amongst advanced economies this year, were most pessimistic on costs. Their forward-looking score on this pillar was -79.0 – the worst score recorded by any country or sector across our five pillars.

Staffing costs generally are the most frequently cited source of cost increases. More than 43% of those surveyed highlighted payroll as the main source of increased costs, with a similar number expecting this to continue over the course of the next year.

These cost increases reflect a historically tight labour market. In the Eurozone, while the jobless rate in the US is below the historical average.

Interest rates and financing costs were also major concerns. Though central banks have been cutting interest rates, they still remain high by recent standards and this affects the servicing costs on loans and other financing products. Businesses coming off previous fixed-term deals will have been particularly exposed to this pressure.

Labour Market

Thrive Index score looking back over past 12 months +34.1

Thrive Index score looking forward to next 12 months +50.4

Global labour markets have demonstrated remarkable resilience in the face of challenging economic conditions. Half of companies surveyed increased headcount over the past year, with widespread optimism about hiring over the next 12 months.

However, a majority of respondents (52%) expect it to become more difficult to hire new staff over the coming year, with potential recruits holding strong bargaining power.

Technology companies, in particular, experienced hiring difficulties. This suggests the race for talent is still ongoing in this sector, despite some reports of layoffs in key markets.

Our survey reveals changing attitudes among employers towards remote working. After widespread adoption in response to the pandemic, business leaders now express a preference to shift back to more traditional working practices. Some 65.4% of respondents said they will likely restructure towards more in-person working over the coming year.

Investment Activity

Thrive Index score looking back over past 12 months +51.1

Thrive Index score looking forward to next 12 months + 64.1

The technology industry may be experiencing problems in hiring staff but the sector is powering ahead on investment activity. Rapid advances in artificial intelligence appear to be driving innovation, giving backward-looking Thrive Index score for technology of 61.8 – and up to 75.6 looking forward.

Investment intentions were strongest in emerging economies, with India, South Africa, and Brazil each recording scores of around 80 on the forward-looking indicator. The lowest scores were recorded in France and the Netherlands.

Nearly half of businesses increased automation over the past year, with the UK, India and Brazil leading the way.

Among businesses that changed their investment levels over the past year, the main area of focus was technology and digital tools. However, increased reliance on technology opens up new risks and 32% of companies said cybersecurity and data protection received extra investment over the past year.

Conclusion

Much economic debate focuses on the impact of economic and trade policies on the huge multinational enterprises that have become household names.

While they are important, the current debate around globalisation has demonstrated how those huge brands rely on an army of specialist suppliers spread across the globe that rarely make the headlines in their own right.

The new Moore Global Thrive Index throws the spotlight on those under-recognised, resilient mid-market businesses that are adept at finding new pathways to success.